UEFA Futsal EURO 2026 betting odds and predictions

The Kelly Criterion is one of the most famous bankroll management strategies used in betting. Its goal is to determine the optimal percentage of your bankroll for a bet to maximise long-term capital growth while avoiding bankruptcy. Unlike flat betting, the Kelly Criterion considers both the probability of an outcome and the bookmaker's odds. It's based on mathematics and probability theory, making it one of the most rational systems.

The main idea of the Kelly Criterion is that you should only place a bet when you have a mathematical advantage over the bookmaker. If the probability of an outcome is higher than the one implied by the bookmaker's odds, you have value and can place a bet. But if the odds are fair or undervalued, according to Kelly, you shouldn't bet at all.

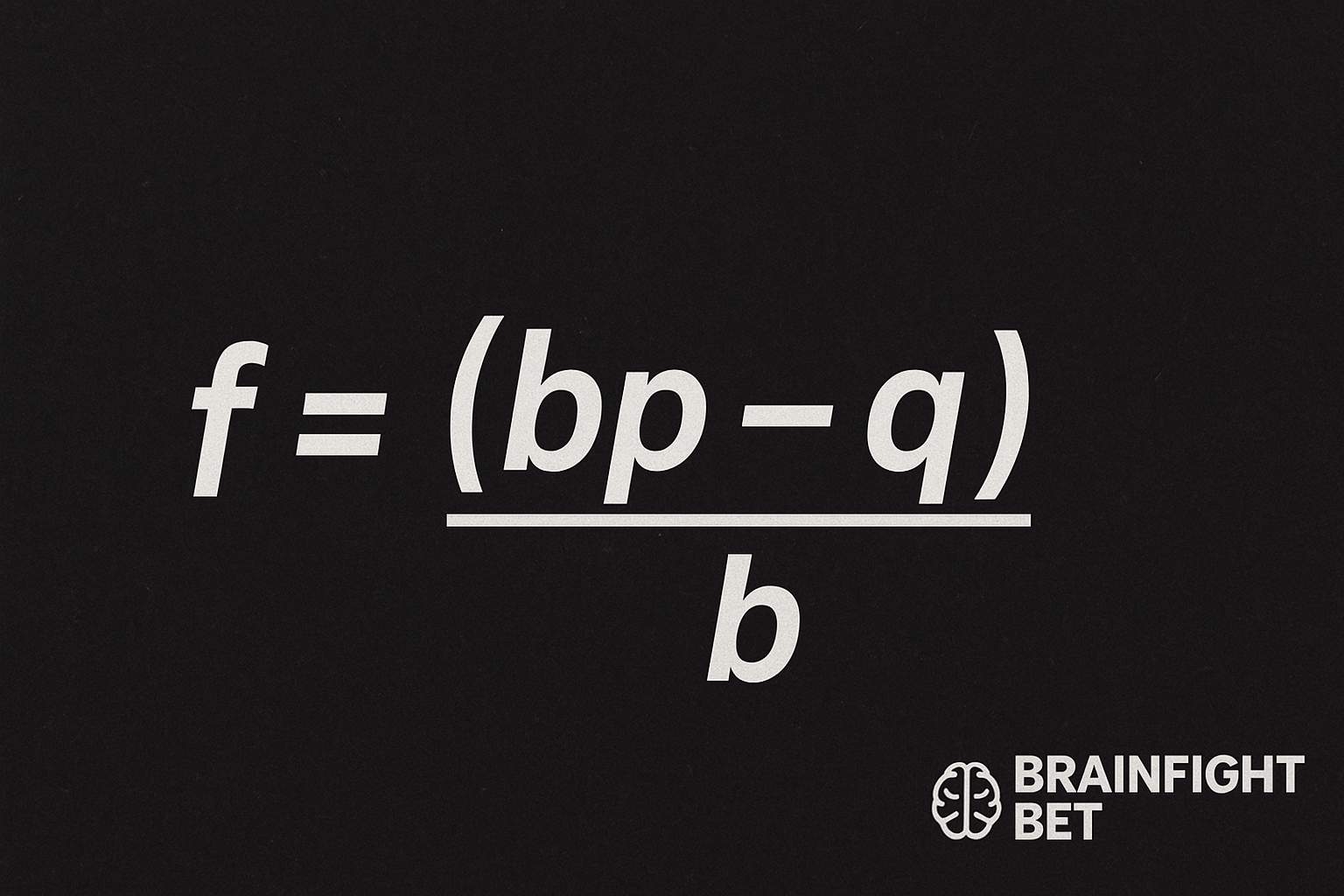

The Kelly formula looks like this: f = (bp – q) / b

where:

f - the percentage of the bankroll to bet,

p - the probability of winning (according to the bettor),

q - the probability of losing (1 – p),

b - the odds minus 1.

For example, if the odds are 2.00 (b = 1), and your estimated winning probability is 60% (p = 0.6), then f = (1 × 0.6 – 0.4) / 1 = 0.2. This means that the optimal bet size is 20% of your bankroll. If the result of the formula is negative, it means you shouldn't bet, as you have no edge over the bookie.

First, it protects you from total bankruptcy. It never suggests betting your entire bankroll – only a portion of it. Second, it maximises the long-term growth of your bankroll. Mathematicians have already proven that the Kelly method produces better results compared to fixed or flat betting over a large number of bets.

However, the Kelly Criterion also has its drawbacks. The main one is the need to estimate the probability of an outcome accurately. If the bettor miscalculates the p, the result can be negative. Another issue is betting a high percentage of your bankroll when the advantage is big. For example, if the formula suggests betting 30-40% of your bankroll, that is surely too risky. To reduce volatility, many use a fractional Kelly approach - for instance, half or a quarter of the formula's result. This lowers profitability but significantly reduces danger.

The Kelly Criterion also highlights an important truth: staking the same amount on every event is a mistake. If an event has high value, the stake should be larger. If the value is minimal or nonexistent, there should be no bet. This approach promotes discipline, encourages analysis of odds, and helps bettors seek genuine advantages.

In practice, the Kelly Criterion is mostly used by professional bettors and investors. It's suitable for long-term strategies that prioritise stability and growth over quick wins. Beginners are advised to start with the fractional version and carefully learn how to assess probabilities.

In conclusion, the Kelly Criterion is not just a formula - it is a philosophy of bankroll management. It teaches you to think mathematically, avoid emotional decisions, and only bet when the odds are truly in your favour. When applied correctly, it becomes a powerful tool that helps you earn consistently and safely in betting.

More news

UEFA Futsal EURO 2026 betting odds and predictions

Super 6 round 30 predictions and tips

2026 Australian Open betting preview – Odds, favourites & predictions (ATP & WTA)

Arsenal vs Kairat Almaty prediction and betting tips January 28, 2026

Bayer Leverkusen vs Villarreal prediction and betting tips January 28, 2026

2026 Men's European Handball Championship predictions and betting odds